Through a proactive strategy for broadening its export opportunities, Egypt is reshaping the market dynamics to sell its agricultural products. In the initial third of the year Egypt’s exports of oranges to Canada are already exceeding the entire amount for 2023. It’s a record-breaking world record for the market delivery of goods in the report by EastFruit.

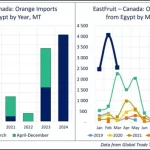

Between between January and March 2024 Canadian importers have procured 9000 tons of oranges in Egypt which is a substantial increase from the a little more than 3,500 tonnes over the same time period in the year before. Additionally, the total import volume throughout 2023 was just 7,600 tonnes. In light of the fact that Egyptian oranges are typically available in Canada through June, the total amount for this year’s imports could be greater.

“As the world’s 14th largest citrus importer Canada as well as Brazil has become a key marketplace for Egyptian exports to the Americas. Even though the volume of imports into Canada aren’t as high as to EU, Russia, or different Asian markets, Egypt’s increasing presence in Canada is a significant win in its agriculture sector. Canada is regarded as one of the top global markets and offers more easy access to markets than say or in the USA,” remarks Yevhen Kuzin, Fruit and Vegetable Market Analyst with EastFruit.

In addition, Egypt, which ranked fourth on the list of suppliers of orange in Canada by 2023 has a chance to take the top spot this year, should the current trend continues, and is just behind the USA in the USA and South Africa. However, Spain and Morocco, the main rivals of Egypt are not seeing the same increases in Canadian exports. Indeed, Canadian importers have halved their imports of the two countries, in the first quarter of 2024 to 3,300 tonnes and 4,300 tonnes, respectively, during the first quarter of 2024 as compared to the same time last year.

“Logistically or seasonalally Egypt might not be able to surpass the USA as well as South Africa in orange exports towards Canada. Other countries who are interested in the market should be prepared for increased pressure with Egyptian exporters. This is especially true in Spain as well as Morocco which is where cultivation of oranges is becoming increasingly impacted due to the effects of climate change. Incredibly, Egypt is also gaining entry to markets in Spanish market for its citrus,” Kuzin adds.

The USA is the only producer of oranges on Canada. Canadian market, either via domestic production or through the re-export of Mexican as well as South American oranges. South Africa dominates the Canadian market during autumn and summer months as Spanish as well as North African suppliers vie for markets from December to the spring. In recent times, Turkey has emerged as one of the contenders, importing 2200 tons of oranges to Canada in the initial quarter of 2018 which is up from 1,600 tonnes in the past year.

“A important factor behind the Egyptian market’s Canadian market’s success is the competitiveness of its prices. In the case of oranges, prices in Egypt decreased to 15 cents per kilogram by the close of April. However, this will not last over the long term because prices are not able to continue to fall forever. Therefore, Egyptian suppliers have to move their attention away from price and other crucial sales aspects. Although Canada places 14th worldwide in the volume of imports from oranges however, it rises to the ninth spot by comparing it to US dollars. This suggests a desire to buy large quantities of citrus, but to be willing to pay more for. Egypt has seen significant progress on the first, however this latter aspect paints an unfavorable picture.” Kuzin concludes.

Source: east-fruit.com