Major changes across different areas will set the world blueberry industry for long-term prosperity. The major trends that will shape the future of this blueberry industry are the increasing sophistication of cultivators’ increased attention to productivity in the workplace and efficiency, according to the latest study conducted from RaboResearch.

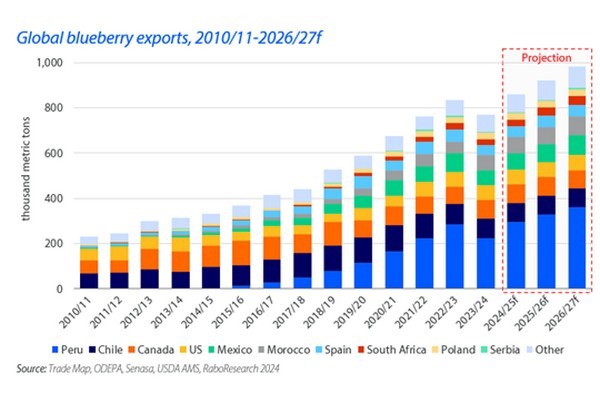

Following a slowdown between 2023 and 2024, blueberry exports will increase to a new high.

The season of blueberries in 2023/24 was unique in that it marked the first time that exports have declined over the course of 15 seasons, due to weather-related events which reduced production in some of the most productive nations. Globally, exports decreased by 10. In addition, recovery of exports and production is anticipated to take longer than originally was anticipated.

“For 2024/25 we are expecting record exports but just 3 percent greater than 2022/23 seasons,” says David Magana the senior analyst for fresh products for RaboResearch. “In the coming seasons, we are expecting returning to the previous growth rates and possibly surpassing the one million metric tonnes threshold by the time of 2027/28.”

While China remains the world leading producer however, it will remain importing South American supply during the season that is not in full swing, and will focus on the quality. The 2023/24 season saw South American blueberry exports recorded the first drop over the course of 11 seasons. It was only the second decline since 2001/02 season.  Nevertheless, Peru will dominate the world blueberry industry, but the fundamental aspects that fuel expansion are undergoing a change. “Variety revival will ensure further increase in the exports of fresh blueberries,” says Magana. “A section of the new plants will be replacing old varieties as well as orchards. Due to the higher proportion of proprietary varieties that are new and a higher percentage of new varieties, we anticipate to see further growth driven by increased yields, not increasing the area planted.” An extensive selection of cultivars can allow growers in diverse regions to extend their time of production in the very near the future. In Peru the season of peak production will likely to extend by a couple of weeks during the previous seasons, to a couple of months by the middle. The flattened curve of production will facilitate a more structured marketing procedure, which will prevent from market saturation, and consequent price declines.

Nevertheless, Peru will dominate the world blueberry industry, but the fundamental aspects that fuel expansion are undergoing a change. “Variety revival will ensure further increase in the exports of fresh blueberries,” says Magana. “A section of the new plants will be replacing old varieties as well as orchards. Due to the higher proportion of proprietary varieties that are new and a higher percentage of new varieties, we anticipate to see further growth driven by increased yields, not increasing the area planted.” An extensive selection of cultivars can allow growers in diverse regions to extend their time of production in the very near the future. In Peru the season of peak production will likely to extend by a couple of weeks during the previous seasons, to a couple of months by the middle. The flattened curve of production will facilitate a more structured marketing procedure, which will prevent from market saturation, and consequent price declines.

The labor market will continue to be a significant issue for farmers across the globe. The workforce is shrinking and this will increase the competition from different sectors. For labor-intensive crops like blueberries, recruiting sufficient workers and managing their housing/transportation is a significant challenge for growers, in particular during the harvest period. “As labor is becoming increasingly difficult and the cost of labor increases, we anticipate that producers will be more focused on this matter and make adjustments, like changing to varieties with larger fruit or better detachability, using machines for harvesting, implementing automated harvesting processes prior to and after and reducing the amount of harvesting operations, as well as prolonging the harvest time,” Magana states.

“Machine harvesting” is going through the process of learning and has to align with orchard’s design and the varieties that are grown. When these issues are resolved successfully, the machine will succeed. It is a matter of when.”

The full report is available here..

For further information:

For further information:

Melanie Bernds

Rabo AgriFinance

[email protected]

https://research.rabobank.com/

Source: The Plantations International Agroforestry Group of Companies