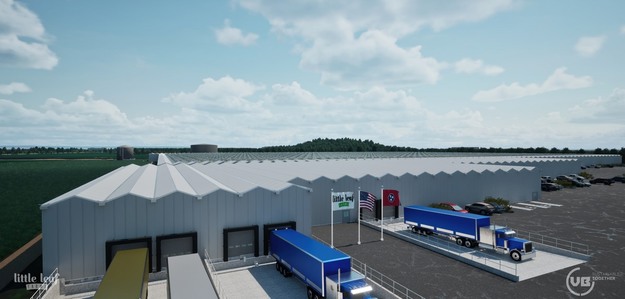

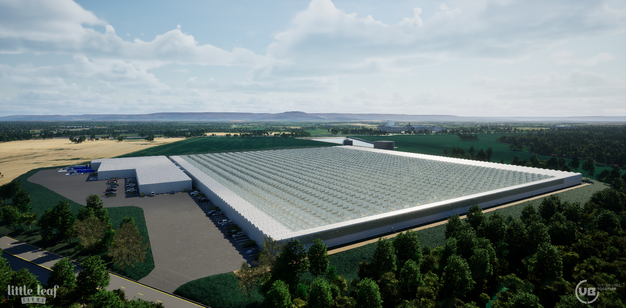

Little Leaf Farms is continuing its expansion with a new campus in Tennessee. The new 215-acre site, located in Manchester, Tennessee, is initially planned for 40 acres of greenhouses, with an option to expand to 80 acres. With financing already in place, Little Leaf Farms will begin construction this summer with an anticipated launch in Fall 2026. Once fully operational, the Tennessee facility will have the capacity to produce enough leafy greens to service the Midwest, Southeast, and Texas. The facility will create several hundred jobs over five years.

Little Leaf Farms is the largest indoor-grown brand in the U.S. with, according to Nielsen market research, over 50% market share among indoor lettuce growers. “This expansion ensures that even more households will have access to greens that are fresher, tastier, and grown more sustainably”, said Paul.

“Consumers are increasingly choosing our fresher, more flavorful greens over field-grown greens,” said Paul Sellew, Founder and CEO of Little Leaf Farms. “This new campus is a testament to our belief in and commitment to the promising future of indoor-grown leafy greens. Strong consumer demand allows us to invest confidently, and we’re grateful to our partners in Tennessee for supporting this next chapter.”

“When we launched Little Leaf Farms ten years ago, our mission was clear: transforming our food system by growing better food in a better way,” said Sellew. “That mission remains our north star. Expanding into Tennessee marks a powerful step forward in delivering fresher, better tasting leafy greens to more consumers across the country.”

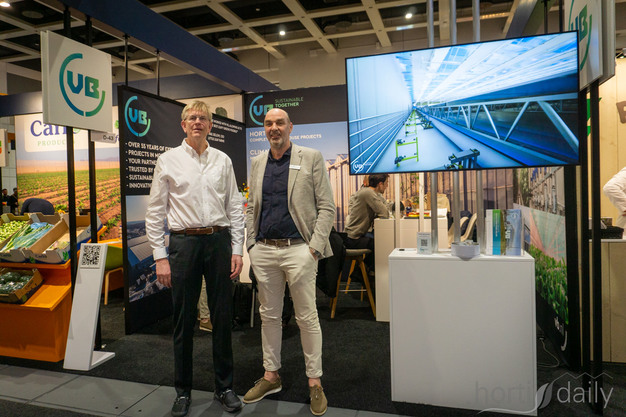

Like all previous Little Leaf Farms facilities, this eighth consecutive construction project will also be carried out by VB. Since its founding in 2016, Little Leaf has consistently collaborated with the Dutch turnkey greenhouse provider, sharing a strong commitment to sustainability and the use of advanced techniques and technologies. The 3D renderings depict the first phase of the new project. In bringing the campus to life, VB will be supported by its Atrium partner PB Tec, along with several other Dutch and local suppliers.

Paul Sellew and Edward Verbakel, VB, at Fruit Logistica 2025.

Paul Sellew and Edward Verbakel, VB, at Fruit Logistica 2025.

Backbone

“Agriculture is the backbone of Tennessee’s economy, supporting tens of thousands of jobs and driving growth in our rural communities,” said Governor Bill Lee. “We’re proud to welcome Little Leaf Farms to our state and grateful for their investment in Tennessee. The company’s commitment to innovation and job creation will strengthen our agricultural sector and expand opportunities for hardworking Tennesseans.”

“On behalf of The City of Manchester, I would like to express our excitement and gratitude that Little Leaf Farms has chosen the Manchester Industrial Park as the site of its newest location,” said Joey Hobbs, Mayor of Manchester. “Thank you to all those who worked to bring Little Leaf Farms here and thank you to Little Leaf Farms for your investment in Manchester and the State of Tennessee.”

For more information: Little Leaf Farms

Little Leaf Farms

[email protected]

littleleaffarms.com